estate planning worksheet pdf

Estate Planning Worksheet PDF: A Comprehensive Plan

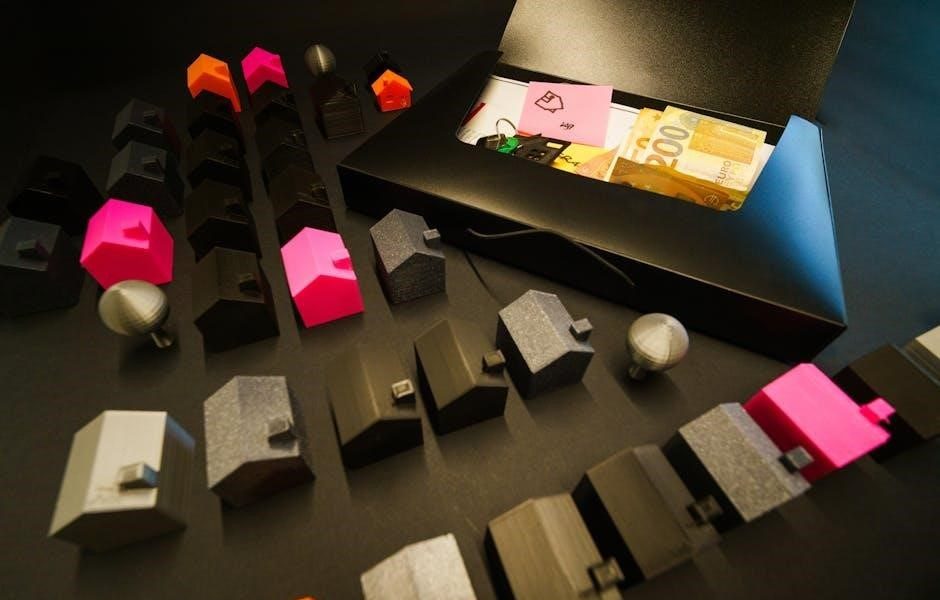

Navigating estate planning requires diligent organization, and a PDF worksheet serves as a central hub for asset and liability details. This comprehensive tool streamlines the process, ensuring no crucial information is overlooked during planning and implementation, offering peace of mind.

Estate planning worksheets, particularly in PDF format, are foundational tools for organizing the complex details of your financial life. These documents aren’t about legal advice, but rather a systematic method for gathering essential information needed by estate planning professionals – or for those undertaking simpler plans themselves.

A well-structured worksheet prompts you to identify all assets, from real estate and bank accounts to retirement funds and life insurance. It also requires a thorough listing of liabilities like mortgages, loans, and debts. Crucially, it emphasizes beneficiary designations, ensuring your wishes for asset distribution are clearly documented.

Using a worksheet ensures a complete list of assets and liabilities, both separate and community, of which you and your spouse have an ownership interest; This detailed inventory is vital for creating a robust and effective estate plan, minimizing potential complications and stress for your loved ones.

Why Use a PDF Estate Planning Worksheet?

Choosing a PDF estate planning worksheet offers several key advantages for organization and security. PDFs provide a standardized, universally accessible format, ensuring compatibility across devices and operating systems. This eliminates formatting issues often encountered with other document types.

Furthermore, PDFs are easily secured with password protection, safeguarding sensitive financial and personal information. They also allow for digital signatures, streamlining the process of review and approval. A completed worksheet serves as a central information packet, bringing peace of mind by eliminating stress for loved ones.

The structured format prompts comprehensive data collection, reducing the risk of overlooking crucial assets or liabilities. This detailed inventory is essential for effective estate planning, enabling informed decisions and minimizing potential legal challenges. It’s a proactive step towards a smoother transition for your heirs.

Identifying Your Assets

A thorough asset inventory is foundational to estate planning, encompassing all property owned, including real estate, accounts, and policies. Accurate listing is vital.

Real Estate Holdings

Documenting your real estate holdings is a critical step in estate planning. Begin by listing each property individually, including the address, and a brief description – for example, primary residence, rental property, or vacation home. Specify how you hold title to each property; is it solely in your name, jointly with rights of survivorship, or as tenants in common?

Detail the current market value of each property, potentially utilizing a recent appraisal or tax assessment. Note any outstanding mortgages or loans secured by the real estate, including the lender, account number, and current balance. Remember to consider any associated costs like property taxes and homeowner’s insurance.

If you own property in multiple states, list each location separately. It’s important to understand how property ownership impacts your overall estate plan, as laws vary by jurisdiction. Don’t underestimate the importance of accurate and complete documentation for a smooth estate administration process.

Bank and Investment Accounts

A thorough inventory of your bank and investment accounts is essential for a complete estate plan. List each account separately, including the financial institution’s name, account type (checking, savings, brokerage, etc.), and the account number. Clearly indicate whether the account is held individually or jointly with another person, specifying rights of survivorship if applicable.

Detail the approximate current value of each account as of today’s date. Include information about any beneficiary designations already in place – these often supersede instructions in a will. Note any investment holdings within brokerage accounts, though a detailed portfolio listing may be kept as a separate attachment.

Remember to include certificates of deposit (CDs), money market accounts, and any other similar financial instruments. Accurate record-keeping ensures a clear understanding of your assets and facilitates efficient estate settlement.

Retirement Accounts (401k, IRA, Pension)

Retirement accounts often represent a significant portion of an individual’s estate, requiring careful documentation. For each 401(k), IRA (Traditional, Roth, Rollover), and pension plan, record the plan administrator’s name, account number, and current approximate value. Specify whether the account is tax-deferred or after-tax.

Crucially, identify the designated beneficiaries for each account. These designations take precedence over your will, so ensure they align with your overall estate plan. Note the date the beneficiary forms were last updated. Include information regarding any survivor benefits available through pension plans.

Maintaining accurate records of these accounts simplifies the transfer process and helps avoid potential tax complications during estate settlement. A complete listing ensures a smooth transition for your heirs.

Life Insurance Policies

Life insurance provides financial security for your beneficiaries, and detailed records are essential for estate planning. For each policy, document the insurance company’s name, policy number, policy type (term, whole, universal, etc.), and the current death benefit amount. Note whether the policy is owned individually or through a trust.

Most importantly, clearly identify the primary and contingent beneficiaries for each policy. Confirm the beneficiary designations are current and reflect your wishes. Include the date the beneficiary forms were last reviewed and updated. Also, record any riders attached to the policy, such as accelerated death benefit riders.

Having this information readily available streamlines the claims process for your loved ones, ensuring a timely and efficient distribution of benefits.

Understanding Your Liabilities

Accurately listing all debts is crucial for a complete estate plan; this includes mortgages, loans, and outstanding balances, providing a clear financial picture.

Mortgages and Loans

Detailing all mortgages and loans is a vital component of a thorough estate planning worksheet. For each property with a mortgage, record the lender’s name, the original loan amount, the current outstanding balance, the interest rate, and the monthly payment amount. Include the property address for easy identification.

Similarly, list any other loans – auto loans, personal loans, student loans, or business loans – providing the same key details: lender, original amount, current balance, interest rate, and monthly payments.

Understanding these liabilities is essential for determining the net worth of the estate and ensuring sufficient assets are available to cover these debts after your passing. Accurate records prevent potential complications and delays during probate. Remember to include any home equity lines of credit (HELOCs) as well, treating them as separate loans with their own terms.

Credit Card Debt

A comprehensive estate planning worksheet must meticulously document all outstanding credit card debt. For each credit card, record the issuing bank or financial institution, the account number (or last four digits for security), the credit limit, and the current outstanding balance as of today, December 22, 2025.

Note the interest rate associated with each card, as this impacts the total amount owed. While seemingly small, credit card debts are legally enforceable against the estate and must be accounted for.

Include any store credit cards or charge cards as well. Accurate documentation ensures a clear picture of the estate’s liabilities, facilitating a smoother probate process and preventing unexpected financial burdens on your heirs. Failing to disclose these debts can lead to legal issues and delays.

Other Outstanding Debts

Beyond mortgages and credit cards, a thorough estate planning worksheet necessitates listing all other outstanding debts. This includes personal loans from banks or credit unions, loans from family members or friends (documenting terms is crucial!), and any judgments or settlements owed to third parties as of December 22, 2025.

Detail the creditor’s name, the original loan amount, the current balance, the interest rate, and the repayment terms. Don’t forget tax liabilities – federal, state, or local – that are currently owed but not yet paid.

Accurate accounting of all debts, both secured and unsecured, is vital for a transparent estate settlement. Omitting debts can create legal complications and diminish the value of the estate available for distribution to beneficiaries.

Beneficiary Designations

Carefully reviewing and updating beneficiary forms for all accounts is paramount; these designations supersede your will, dictating asset distribution directly to named individuals.

Reviewing Existing Beneficiary Forms

Begin by gathering all documentation related to accounts with beneficiary designations. This includes life insurance policies, retirement accounts (401k, IRA, pension plans), and investment accounts. Scrutinize each form to confirm the listed beneficiaries align with your current wishes. Pay close attention to the full legal names, dates of birth, and share percentages assigned to each beneficiary.

Often, life events like marriages, divorces, births, or deaths necessitate updates to these forms. An outdated beneficiary designation can lead to unintended consequences, potentially causing assets to pass to someone you no longer intend to benefit. Furthermore, ensure the forms are properly signed and dated, adhering to the specific requirements of each financial institution. A complete and accurate review is a critical step in effective estate planning, preventing future complications and ensuring your assets are distributed according to your desires.

Updating Beneficiary Information

Once you’ve reviewed your existing beneficiary forms, promptly update any discrepancies or outdated information. Contact the financial institution or plan administrator directly to obtain the necessary forms for changes. Complete these forms meticulously, double-checking all details – names, addresses, dates of birth, and percentage allocations – for accuracy.

Remember to clearly indicate whether you are replacing a beneficiary entirely or simply modifying their share. Submit the updated forms along with any required supporting documentation, such as a copy of a marriage certificate or birth certificate. Maintaining accurate beneficiary designations is paramount; it ensures your assets are distributed efficiently and according to your current intentions, avoiding potential legal challenges and delays. Regularly revisit these designations, especially after significant life changes.

Importance of Contingent Beneficiaries

Designating contingent beneficiaries is a critical, often overlooked, aspect of estate planning. These individuals receive assets if your primary beneficiary predeceases you. Without a contingent beneficiary, assets may default to your estate, triggering probate – a potentially lengthy and costly legal process.

Contingent beneficiaries provide a safety net, ensuring your wishes are still honored even in unforeseen circumstances. Carefully consider who you would want to receive your assets if your primary beneficiary is unable to. Regularly review and update these designations alongside your primary beneficiary choices, especially after life events like births, deaths, or divorces. A well-defined contingency plan demonstrates foresight and protects your legacy, streamlining asset distribution and minimizing potential family disputes.

Essential Estate Planning Documents

Key documents—wills, powers of attorney, and healthcare proxies—form the foundation of a solid estate plan. These legally binding instruments ensure your wishes are respected and followed.

Will Creation and Updates

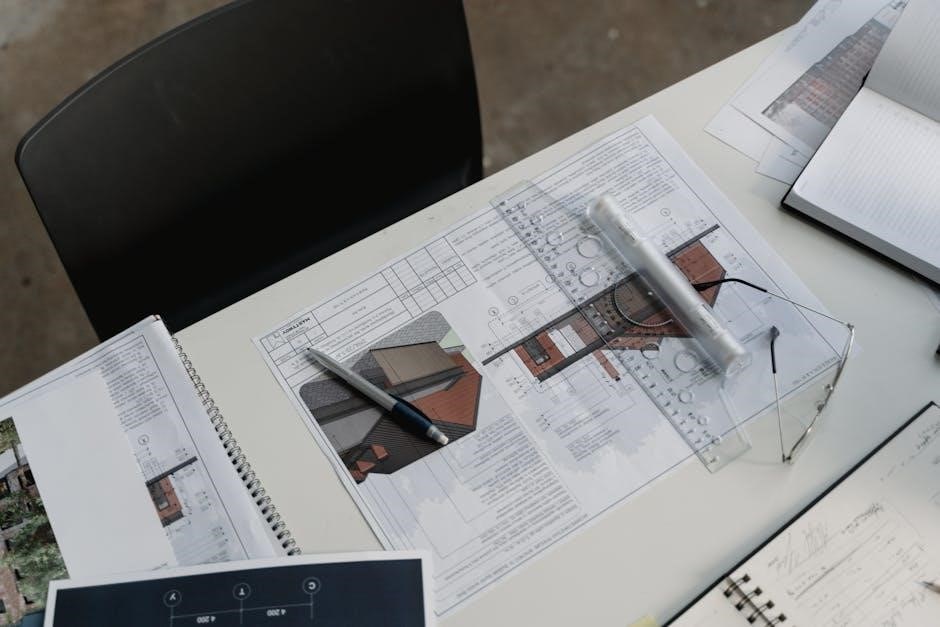

A will is the cornerstone of most estate plans, dictating how your assets are distributed after your passing. Utilizing an estate planning worksheet PDF helps meticulously document beneficiaries, specific bequests, and guardianship designations for minor children. Initial will creation requires careful consideration of state laws and potential tax implications.

However, a will isn’t a “set it and forget it” document. Life events – marriage, divorce, births, deaths, significant asset changes – necessitate regular review and updates. The worksheet serves as a valuable record of these changes, prompting revisions to ensure the will accurately reflects your current wishes.

Failing to update a will can lead to unintended consequences, potentially causing disputes among heirs or resulting in assets being distributed according to outdated instructions. A properly maintained will, guided by a detailed worksheet, provides clarity and minimizes potential legal challenges, safeguarding your legacy.

Durable Power of Attorney

A Durable Power of Attorney (DPOA) is a vital estate planning tool, allowing you to appoint someone to manage your financial affairs if you become incapacitated. An estate planning worksheet PDF facilitates a thorough listing of powers granted, specifying the scope of authority given to your chosen agent. This includes managing bank accounts, paying bills, and handling property transactions.

The “durable” aspect ensures the DPOA remains valid even if you become mentally or physically unable to make decisions. Careful consideration should be given to selecting a trustworthy and responsible agent. The worksheet aids in documenting alternate agents, providing a backup plan should your primary choice be unavailable.

Regularly reviewing and updating your DPOA, alongside your overall estate plan, is crucial to reflect changing circumstances and ensure your wishes are accurately represented. A well-defined DPOA offers peace of mind, knowing your finances will be managed according to your preferences.

Healthcare Proxy/Advance Directive

A Healthcare Proxy, also known as an Advance Directive, empowers you to designate someone to make medical decisions on your behalf if you are unable to do so. An estate planning worksheet PDF provides a structured format to document your healthcare wishes, including preferences for life-sustaining treatment and pain management.

This crucial document ensures your values and beliefs are honored, even when you cannot communicate them directly. The worksheet helps identify your healthcare agent, outlining their authority and responsibilities. It’s vital to discuss your wishes openly with your agent and family members.

Regularly reviewing and updating your Advance Directive is essential, especially after significant life events or changes in your health. A clearly defined Healthcare Proxy alleviates burden on loved ones during difficult times, ensuring your medical care aligns with your desires.

Related Posts

divorce papers colorado pdf

Need Colorado divorce papers *fast*? Download official, state-specific PDF forms instantly. Simple instructions & save time/money! Get started now.

comprehension for class 2 pdf

Boost your 2nd grader’s reading skills with our free comprehension worksheets in PDF format! Engaging stories & questions make learning enjoyable. Download now!

the bell jar by sylvia plath pdf

Explore Sylvia Plath’s iconic novel, ‘The Bell Jar,’ with our free PDF! Uncover themes of identity, societal pressure, and mental health. Start reading now!